Tokenomics

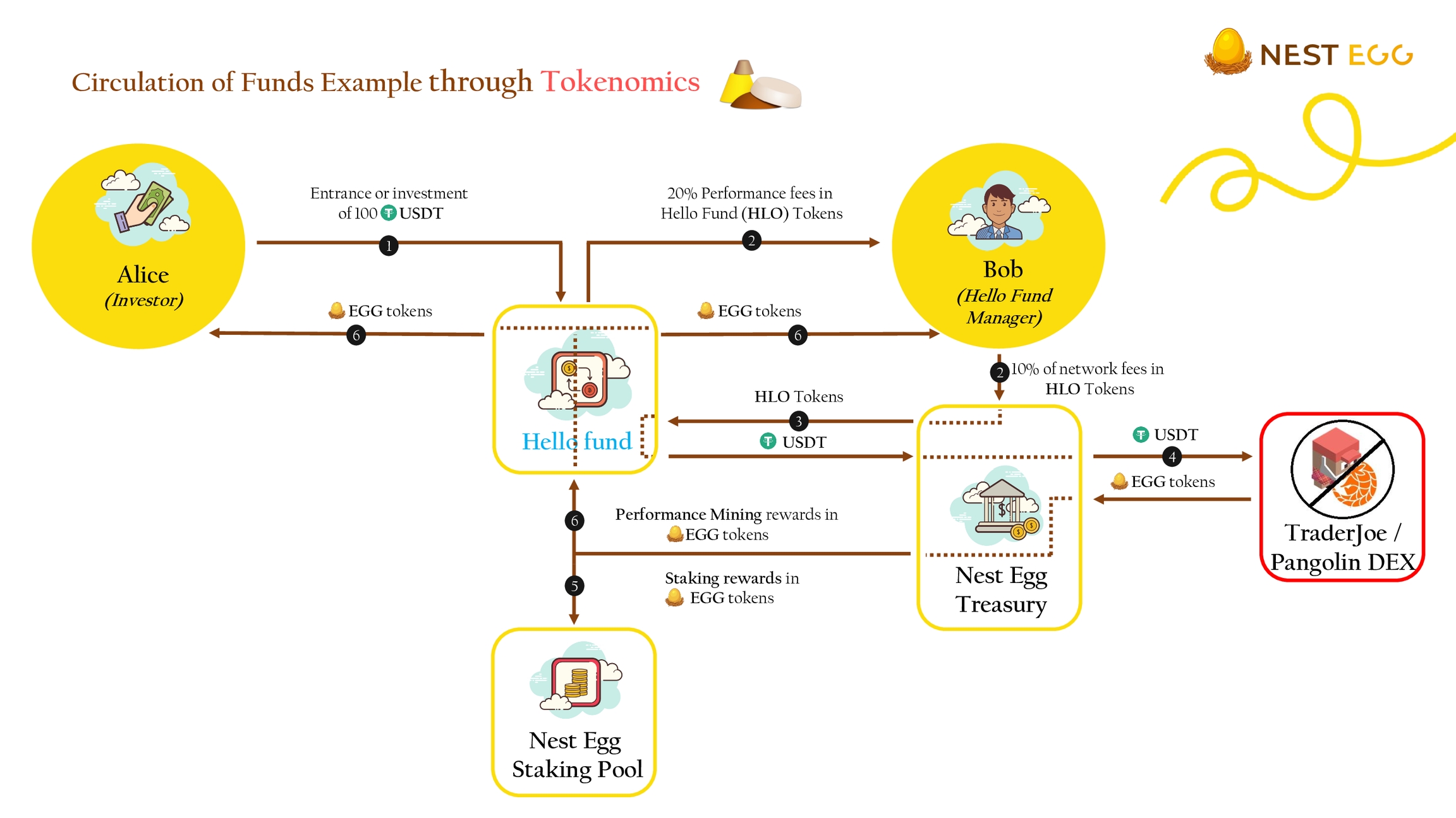

Tokens are redistributed according to a dynamic approach that aims to allocate the network's resources where they are best suited. This is done either by rewarding users and encouraging network growth (i.e. re-investment) or by rewarding token stakers (i.e. dividends).

Alice, the investor, is excited when she sees the Hello Fund's statistics in the Nest Egg leaderboard. She decides to invest 100 USDT in the Hello fund.

After some time (as stated in the fund terms), Bob, as the fund manager of Hello fund, decides to take his performance fees. The performance fees are paid to the fund managers in Hello fund tokens (HLO), and a portion (network fees) is allocated to the Nest Egg Treasury.

The treasury redeems the network fees (HLO tokens) for USDT from the fund.

Treasury exchanges USDT for EGG tokens via TraderJoe / Pangolin DEX.

A minimum percentage of purchased EGG tokens is distributed to EGG Stakers as determined by the Staking Reward Ratio.

A portion of the purchased EGG tokens will be distributed to the best performing mutual funds in the network for the performance mining program. Investors share this with the fund manager in a ratio determined by the manager (as specified in the terms and conditions of the funds).

Last updated